Who brings new Bitcoin into the World?

No company presses a “mint” button for Bitcoin. New coins show up when miners do one thing well: package valid transactions into a fresh block, guessing a valid has and broadcast the full block to the network.

About every ten minutes, a miner finds a block. The protocol currently pays 3.125 BTC to the winner. This is the block reward. These 3.125 BTC are newly created and that’s the way new bitcoin enter circulation.

The amount keeps shrinking

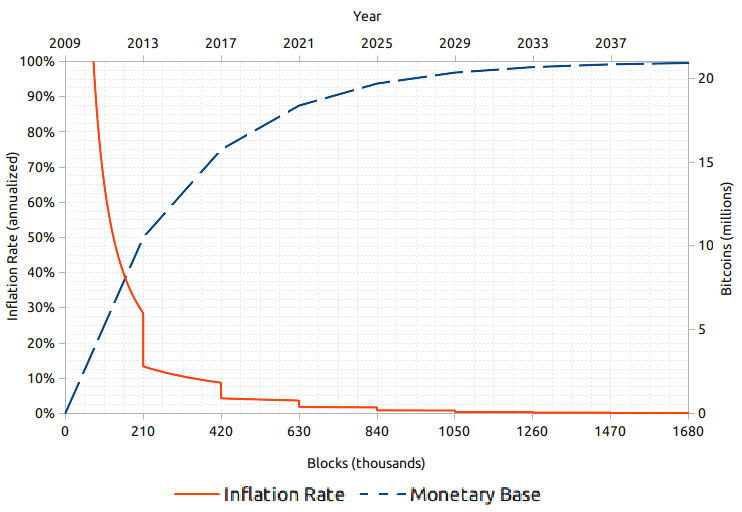

Bitcoin has a built-in slow-down called the halving. Every 210,000 blocks (roughly four years), the block reward gets cut in half. Keep doing that long enough and you approach a hard cap of ~21 million coins. Changing that cap would require broad consensus across miners and node operators, which is realistically not happening.

Why more machines don’t create more bitcoin

You could now think, that if you just use more miners, that you can create more blocks and get a higher amount of bitcoin as reward. But when miners add more computing power (hashrate), Bitcoin auto-corrects via the difficulty adjustment: every ~2016 blocks (about two weeks), the network tweaks how hard it is to find a block so the average block time stays near ten minutes. If hashrate shoots up, difficulty rises; if hashrate falls, difficulty drops. Net result: the issuance pace stays on schedule—more machines can’t change not how many coins get created overall.

Where those coins usually go

Mining isn’t just code; it’s hardware, teams, and especially electricity. Most bills are paid in local currency, so some miners sell part of their rewards right away (on exchanges or OTC) to cover costs. As the reward halves over time, this steady sell pressure should matter less. If energy providers start accepting BTC directly, miners could pay some costs without selling. It also gives them the incentive to mine in the most efficient way, with cheap energy.

Final Thoughts

- New bitcoin appear as block rewards (currently 3.125 BTC) roughly every ten minutes.

- Halvings reduce issuance on schedule until the ~21M cap is reached.

- Miners often sell some rewards to pay costs, so issuance creates baseline sell pressure that fades over time.