Can the limit of 21 Million Bitcoin be changed?

The 21 million BTC ceiling is one of Bitcoin’s defining traits. In theory, any software rule could be altered. In practice, this one is extraordinarily hard to move. Bitcoin’s incentives and its bottom-up governance make a change to the money supply both unattractive and nearly impossible to push through. So where does the number come from, who enforces it, and why is a change so unlikely?

Where scarcity actually comes from

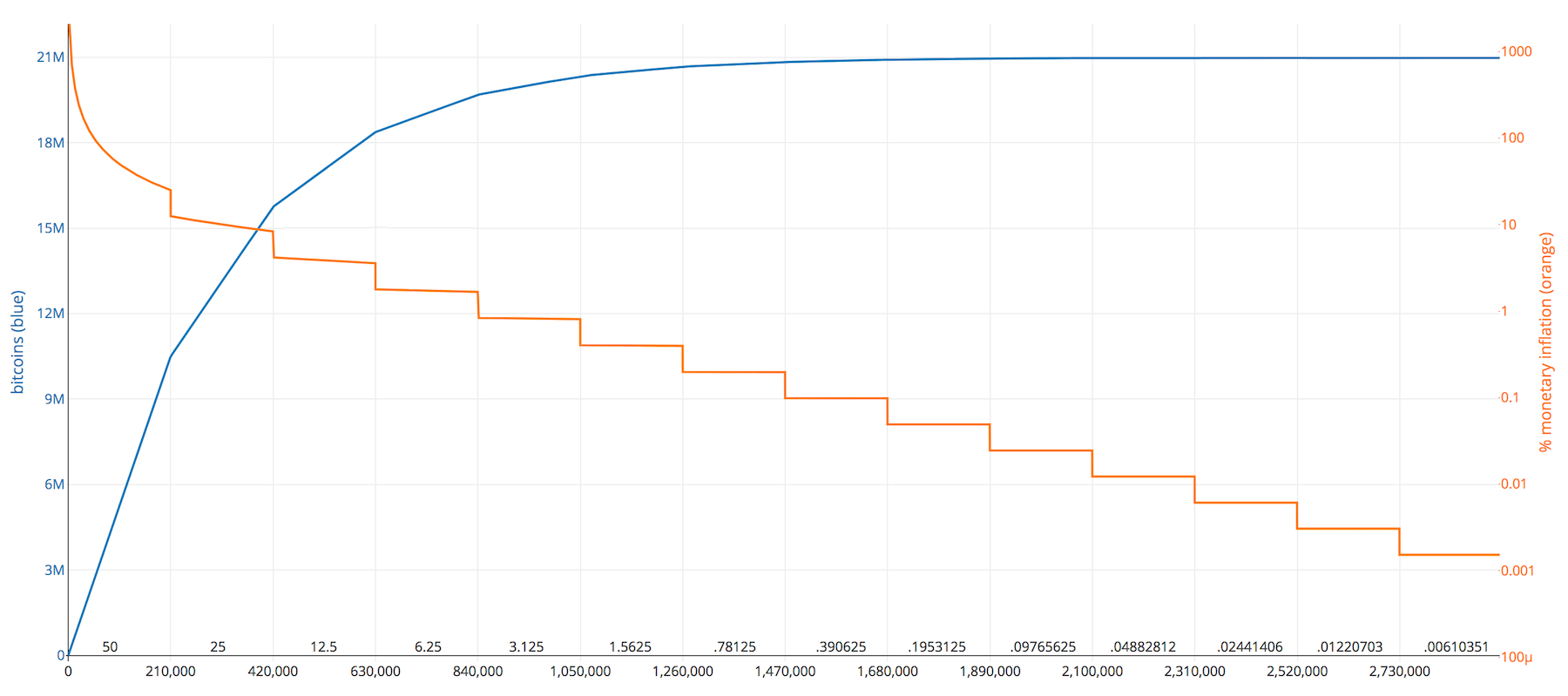

New bitcoin enter circulation only via block rewards paid to miners. That reward cuts in half roughly every four years (the “halving”). Each cut slows issuance further until, near the end of the century, it asymptotically approaches zero. Sum that series of rewards and it converges on ~21,000,000 BTC.

Full nodes enforce this in the real world. They validate every block and reject any block that tries to mint more BTC than the rules allow. No company signs off on this—thousands of independently run nodes do.

Why 21 million?

Satoshi Nakamoto had to pick parameters before knowing how adoption would unfold. The choice was a pragmatic balance:

Scarce enough to create real hardness.

Usable in everyday life thanks to divisibility: each bitcoin splits into 100,000,000 satoshis.

Technically, the path to 21M comes from the emission math Satoshi chose: ~10-minute block interval, an initial 50 BTC reward, and a halving every 210,000 blocks (50 + 25 + 12.5 + …). That geometric series converges to 21,000,000. Satoshi described it as an educated guess—tight scarcity without sacrificing day-to-day utility.

Blue: Bitcoin Supply/ Orange: Inflation rate

Why the cap is effectively untouchable

Two big forces make “more coins” a non-starter:

Incentives: Inflating supply would nuke Bitcoin’s core value proposition—predictable scarcity. Confidence would erode, and price would likely fall hard.

Economics for miners: More nominal BTC doesn’t help if the fiat-denominated revenue drops. Miners pay for power, hardware, and staff in local currency. A price crash would crush margins.

Institutional holders and long-term investors are here because of the fixed cap. Diluting it saws off the branch they’re sitting on.

Nodes set the rules, not miners

No central switch: There isn’t “one true” Bitcoin program. Tens of thousands of nodes run different versions and implementations. Each independently verifies blocks and rejects rule breaks.

Miners follow, they don’t lead: A block paying itself too much coinbase reward gets tossed by nodes. The miner burns electricity for a block nobody accepts.

History backs it up: In the 2017 blocksize conflict, most hash rate signaled for a rule change; users and node operators refused—and won. Consensus lives with the nodes.

Could it be changed at least on paper?

Only via a contentious, uphill process:

Proposal & code: Developers draft and implement a change.

Debate: The community would need convincing—expect heavy pushback.

Activation path: Changing supply would require a hard fork. Everyone has to move together—or split.

Split reality: A large cohort would keep the original rules. You’d end up with two networks and two coins. The legacy chain retains the “hard scarcity” premium. You can’t retroactively erase that.

Do miners have a reason to try?

Short-term, “more coins” might sound enticing. Long-term, miners care about profitability in fiat terms. If trust drops and price falls, their actual margins shrink. That’s the heart of why the economic incentives defend the cap rather than undermine it.

What if someone pushes it anyway?

Markets would sort it out:

The inflationary fork would get its own ticker and price.

The original 21M chain would continue.

Users, businesses, and exchanges would vote with their feet. Historically, the rule-conservative network wins.

Final thoughts

- Scarcity isn’t just code; it’s incentives.

- Nodes enforce the monetary rules; miners earn within them.

- Any attempt to inflate supply would likely split off a new coin—not “change Bitcoin.”