UTXO management is essential for efficient bitcoin handling. This 5-minute guide will help you understand and save money with UTXO management.

What is a UTXO?

UTXO stands for Unspent Transaction Output. It represents the bitcoin in your wallet that hasn’t been spent in a transaction yet.

What Does This Mean?

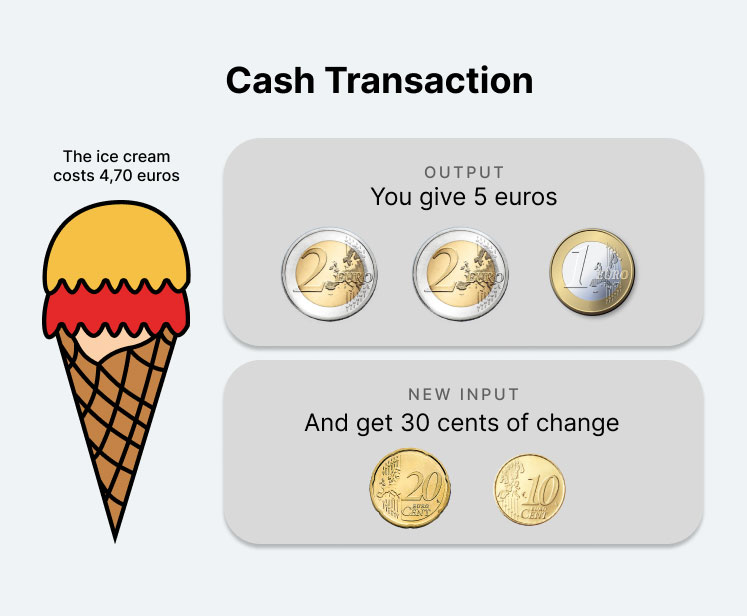

Let’s use a simple analogy. Imagine buying an ice cream for 4.70€. You pay with two 2€ coins and one 1€ coin (Output). You receive a 20-cent and a 10-cent coin as change (Newly Created Input).

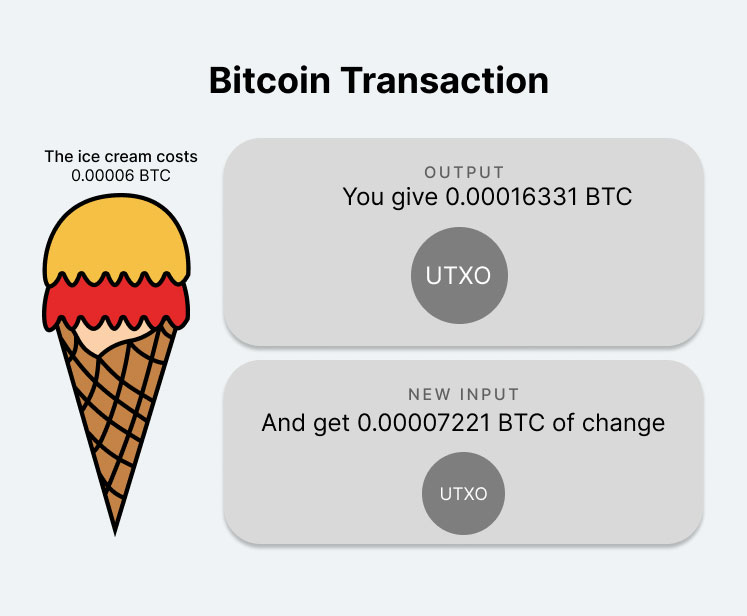

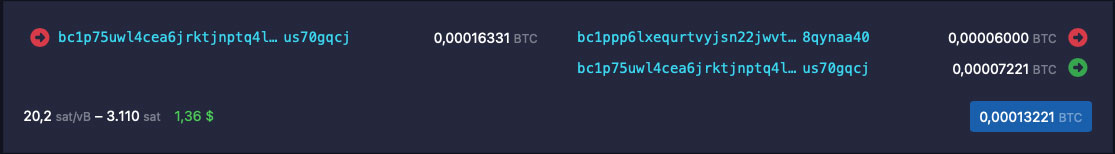

For bitcoin, the process is similar. Suppose you have 0.00016331 BTC in your wallet and pay somebody 0.00006000 BTC for a purchase. You would then create a transaction to spend 0.00006000 BTC to the recipient while sending 0.00007221 BTC as change to yourself. In this example there are 3.110 Sats of transaction fees.

On chain, this transaction would look like this:

How are UTXOs created?

UTXOs can be created in one of three different ways:

- Receiving bitcoin (Input)

- Spending bitcoin (Output).

- Receiving change from a bitcoin transaction (New Input)

Input: What you receive

When someone sends you bitcoin, for example when you buy bitcoin on bittr or you get paid for a service in bitcoin. Each time you receive bitcoin, a new UTXO is created.

Output: What you send

When you want to buy something or send bitcoin to someone else, you have to use one or more of your existing UTXOs. It’s like taking coins out of your wallet to give to someone else.

New Input: The change you get

Most of the time when you pay something with cash, you don’t have the exact amount of coins to pay the seller. In return we get change. The same concept applies for bitcoin: In bitcoin, this change is a new UTXO in your wallet.

The difference to cash is that bitcoin doesn’t have standard denomination sizes like cash. Where you have 5€, 10€ and 20€ bills in cash, a bitcoin UTXO can have any size and therefore is unique.

Why does it matter to you? It is key to determine the fees you pay!

The number of UTXOs participating in a transaction determines the transaction cost for you. The size of a transaction is influenced by the number of Input UTXOs (the ones spent) and the number of Output UTXOs (the new ones created in the transaction).

The larger the transaction, the higher the fees.

When you send a transaction, the amount of inputs needed for a transaction is determined by the types of transactions you’ve received before. Just like with physical cash, if you’ve only received 5€ bills and want to buy something worth 50€, you’ll need to use ten 5€ bills for that purchase, while if would have received one 50€ bill before, you would only need to spend this one bill.

With cash, the amounts of inputs (i.e. ten bills of 5€) don’t increase the fee of the transaction, while in bitcoin you have to pay higher fees for the transaction with 10 inputs than for the transaction with only one input.

UTXO Consolidation: How to save money and pay less fees

If you stack sats in a regular interval, such as a weekly or even daily you might end up with a lot of small inputs in your Piggy Bank. This not only results in higher transaction fees when receiving these purchases but also in the future when using these UTXOs for sending transactions.

To consolidate your UTXOs, you simply have to send a transaction to yourself. This transaction takes all the small inputs and creates one bigger output.

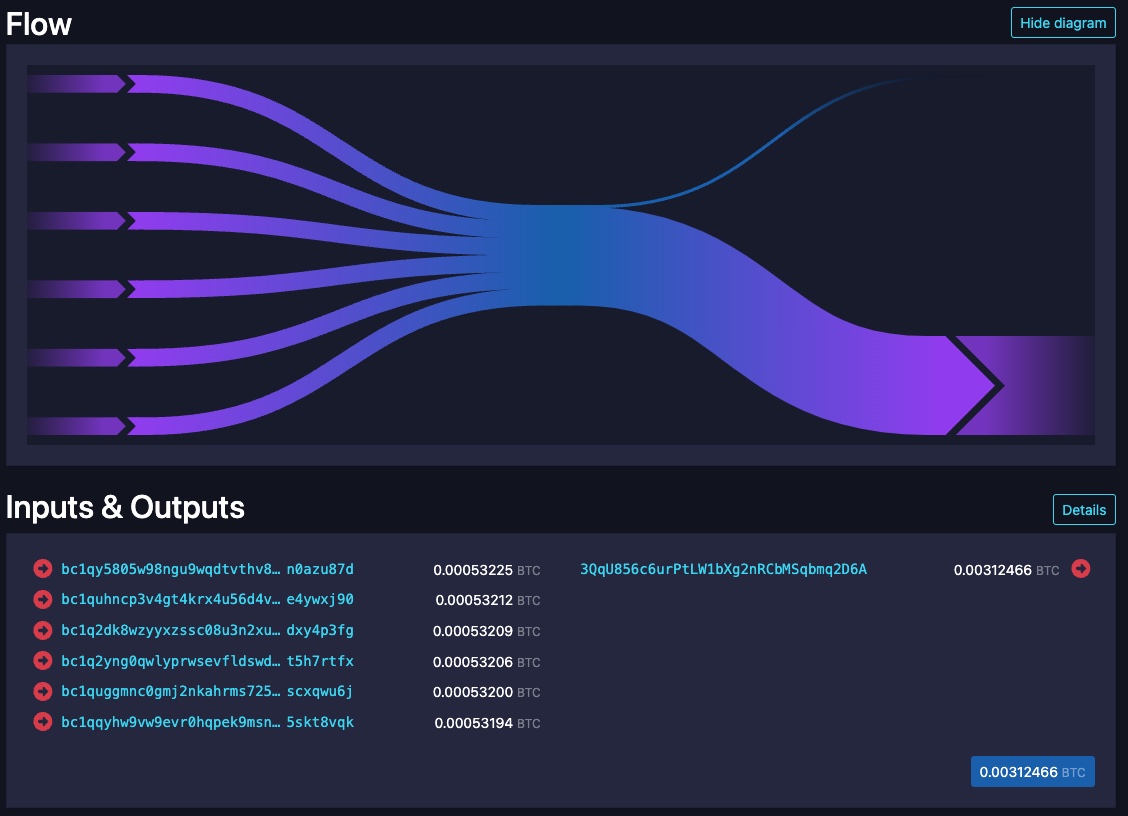

A consolidation looks like this:

Protect your privacy: we’ve got your back

For reasons of privacy, it may make sense not to merge certain UTXOs with each other. Remember: whoever sends you bitcoin knows the transaction. Be aware of the following:

- who you have received which transaction from, and

- who would receive information about your bitcoin holdings in the event of consolidation

Various UTXOs all obtained through transactions from bittr can be consolidated without any problems. No other party is involved when you buy using bittr.

Pro tip: If you want to consolidate your UTXOs you should do that in low fee environment to save transaction fees. 😉