Reading Time: 4 mins

What Is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging (DCA) is an investment method where you buy a fixed amount of an asset regularly, regardless of its price. Think of it as investing on autopilot—you’re not stressing over the perfect timing to enter the market. It’s about building your position steadily over time. It’s more about saving than investing.

For Bitcoin, this typically means setting up recurring purchases (daily, weekly, or monthly), so you accumulate bitcoin bit by bit. Whether prices spike or dip, you stick to the plan.

For example, instead of investing €5000 in Bitcoin at once, you could divide it into €100 weekly investments over 50 weeks. This approach smooths out market volatility. Many people already use a similar strategy for their retirement or savings plans.

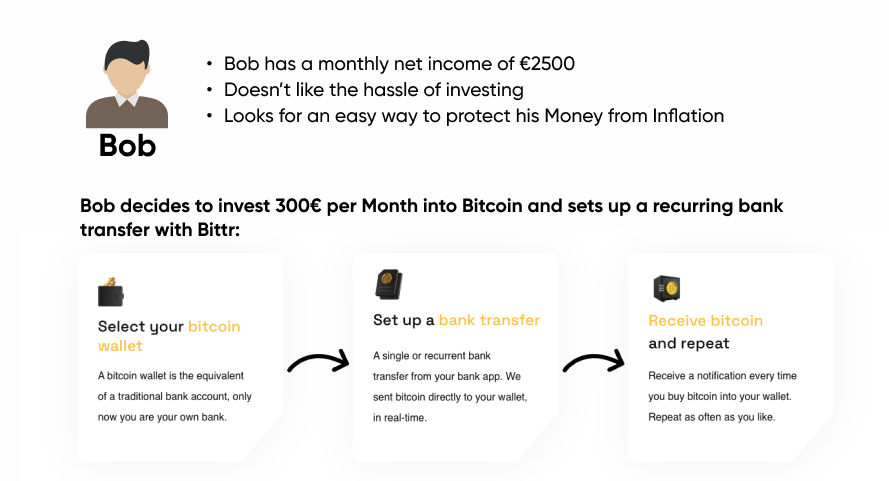

Another example is the Strategy of Bob. He has decided that he can set aside €300 per month. However, he doesn’t want to keep this money in fiat but save it in Bitcoin, as he doesn’t expect it to loose value in the long term. Bob is not a fan of big investment strategies and doesn’t want to worry about this alongside his full-time job:

Why Focus on DCA Gains?

The beauty of DCA isn’t just its simplicity, it’s how it helps you take advantage of Bitcoin’s price fluctuations.

- Buying at Various Prices: By spreading your purchases, you avoid the risk of buying all your Bitcoin at a high price. When the price dips, you automatically buy more for the same amount of money.

- No Need to Time the Market: Timing the market is nearly impossible, even for the pros. DCA eliminates this stress while keeping you consistently invested.

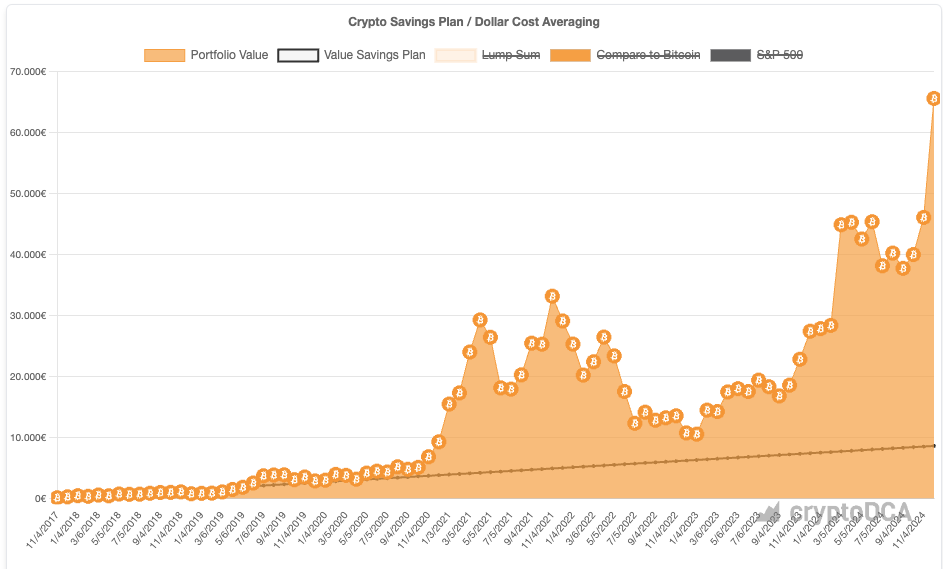

Bitcoin DCA in Practice

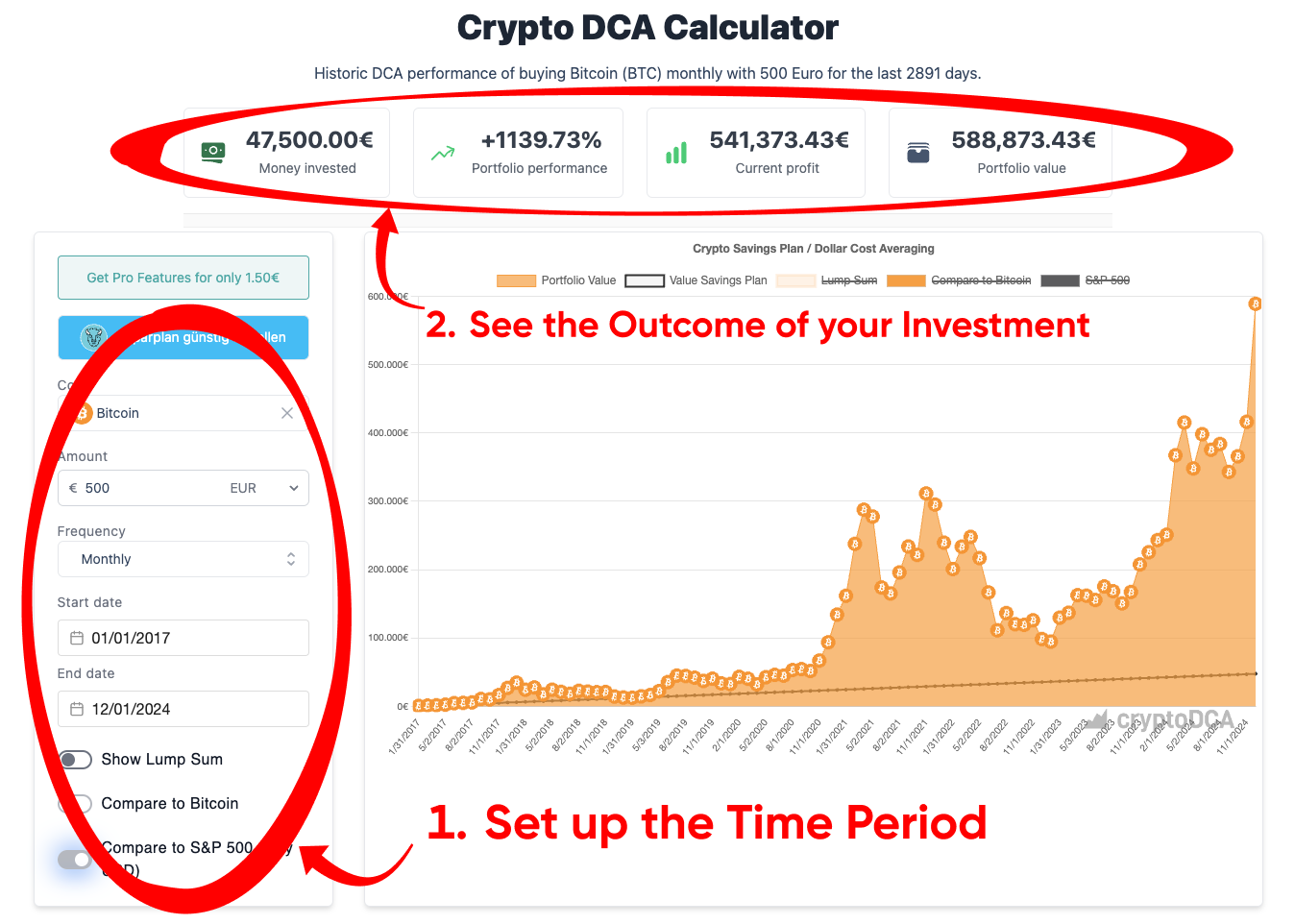

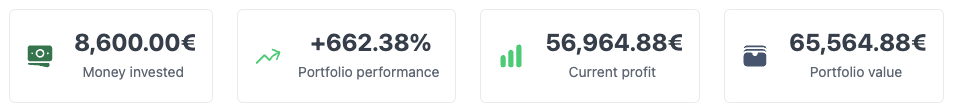

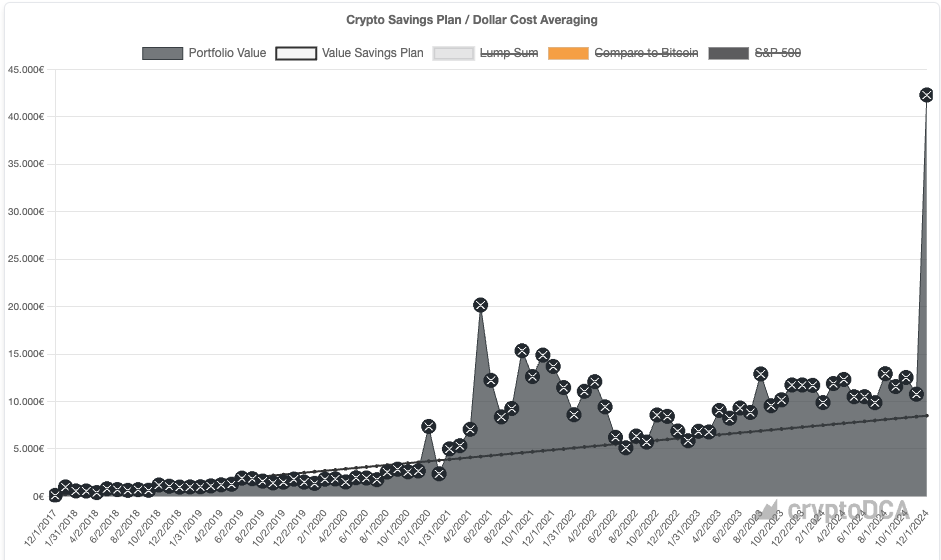

Source: CryptoDCA

A monthly invest of 100€ from 12/2017 - 12/2024 would have brought you:

What about other Cryptos?

*Disclaimer: We strongly believe that no other cryptocurrencies offer the same level of scarcity, decentralization, and resilience as Bitcoin. While we’re sharing this DCA strategy for Ripple, it’s important to note that we do not recommend any cryptocurrency other than Bitcoin as a long-term store of value. Always conduct your own research and understand the risks before investing.*

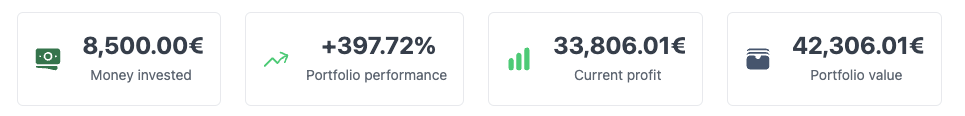

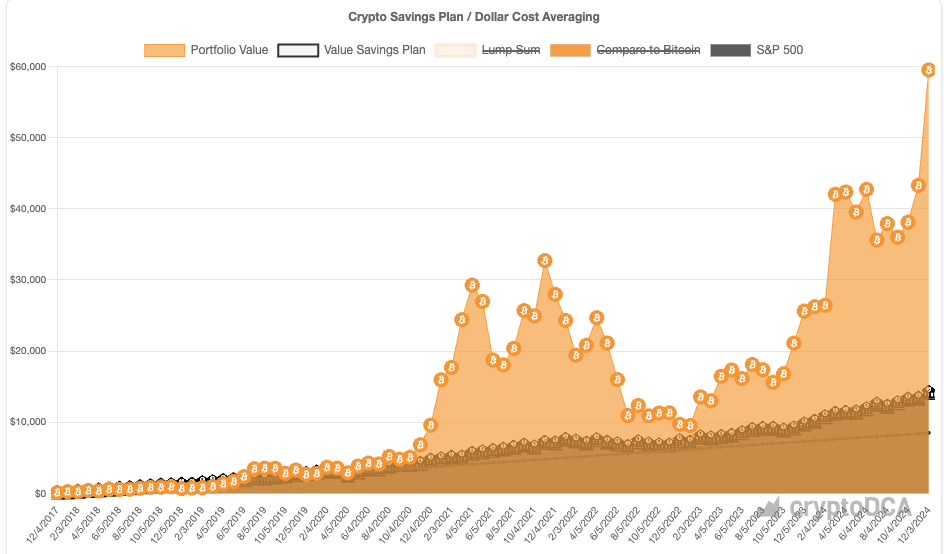

Over the same period of time, a DCA investment in XRP has the following outcome:

Source: CryptoDCA

What about Stocks?

Dollar-cost averaging (DCA) into the S&P 500 has been a proven strategy for long-term investors, allowing consistent growth by spreading investments over time. Historically, the S&P 500 has increased in value, reflecting the strength of the U.S. economy. However, while this index is a reliable choice for steady returns, it’s worth noting that Bitcoin has far outperformed the S&P 500 in terms of growth, offering unparalleled returns over the past decade as the world’s first truly scarce and decentralized asset.

Bitcoin vs. S&P 500, Source: CryptoDCA

In conclusion, while dollar-cost averaging into the S&P 500 or various cryptocurrencies may provide returns over time, Bitcoin stands out as the clear winner. Bitcoin has consistently outperformed both traditional markets and altcoins. You can make significant gains with altcoins, but they come with high risk and uncertainty. For those seeking a long-term store of value, Bitcoin remains the superior choice in a DCA strategy.

DCA and Realistic Expectations

While DCA is a powerful strategy, it’s important to manage expectations:

- No Immediate Profits: DCA works best over the long term. Don’t expect to see huge gains in a few weeks or months.

- Steady Growth Over Time: The goal is to average out your purchase price, not to gamble on quick profits.

Setting Up a Bitcoin DCA Plan

If you’re ready to start DCA into Bitcoin, here’s how to get started:

- Decide Your Budget: Choose an amount you can comfortably invest without worrying about daily prices.

- Pick a Schedule: Set up recurring buys daily, weekly, or monthly.

- Stick to the Plan: No matter how tempting it is to adjust based on price, stay disciplined.

With services like Bittr, automating your DCA plan is easy. Your Bitcoin go straight into self-custody and you don’t have to trust anyone with your Money.

Calculate historical DCA by yourself

Crypto DCA offers you the possibility to calculate historical DCA savings plans. You can also compare how Bitcoin would have developed with other cryptocurrencies in the past. Go to CryptoDCA

Here is how it works: