The Difference between Bitcoin and a Bitcoin ETF

ETFs have brought Bitcoin into the centre of traditional finance. Today, investors have three main paths: buy and self-custody bitcoin, invest via a spot or futures ETF, or invest in mining infrastructure. All options give you price exposure, but they differ in costs, control, risks, and operations. Let’s explain the key differences, highlights benefits and pitfalls, and helps you decide which approach fits your situation.

What is an ETF?

An Exchange Traded Fund (ETF) tracks the value of an underlying asset or a basket of assets and trades on an exchange like a share. The ETF price follows the fund’s net asset value. Through “authorised participants”, new shares are created or redeemed so the market price stays close to the fund’s value. For investors, buying an ETF feels like buying a share: familiar brokerage accounts, clear statements, and known tax routines.

What is a Bitcoin ETF?

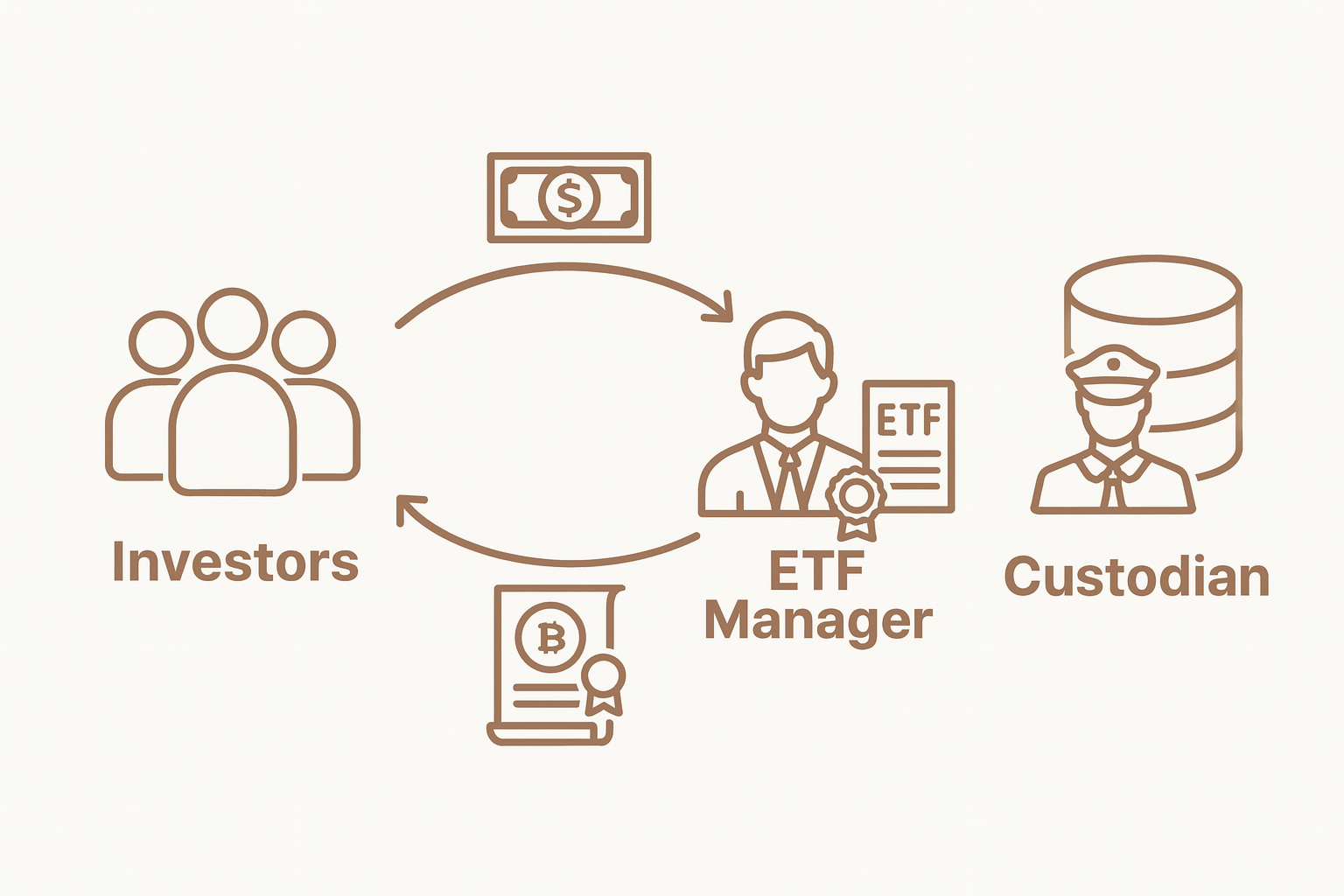

A Bitcoin ETF gives you exposure to Bitcoin’s price without setting up wallets or securing keys yourself. There are two main designs:

Spot Bitcoin ETFs. Spot ETFs hold real bitcoin as fund assets. When you buy shares, the fund buys bitcoin. When you sell, the fund sells. The goal is to track the spot price closely. A specialised custodian holds the coins with professional security processes. As an investor, you stay in your normal broker setup, you own fund shares, not the coins.

Futures Bitcoin ETFs. Futures ETFs do not hold bitcoin. They hold futures contracts on bitcoin. These contracts expire and must be rolled. Rolling can add costs or create differences versus the spot price. Futures ETFs are a more indirect exposure: you are exposed to the futures curve and take on basis and roll risks.

Costs and returns of a Bitcoin ETF

ETFs charge an ongoing management fee (expense ratio). It is not billed to you directly, but it is taken from the fund’s assets and quietly reduces returns. Since competition began, spot Bitcoin ETF fees have typically been in the low per-mille to low single-digit percent range per year.

For long-term investors, even a small annual fee compounds over time. Direct bitcoin purchases do not have this annual fee, but you pay buy/sell fees, possible deposit/withdrawal fees, and you handle your own custody. In the end, your time horizon and your security setup determine what is best.

Cash vs in-kind

ETFs create and redeem shares in two ways:

Cash model: Authorised participants deliver cash; the ETF buys or sells the necessary bitcoin in the market.

In-kind can reduce trading frictions, taxes, and tracking errors because fewer open-market trades are needed and the holdings move more efficiently.

The cash model gives the ETF cleaner process control but requires extra trading. For you as the end investor, the key point is: this mechanism affects how tightly the ETF tracks the spot price and how efficiently inflows and outflows are managed.

Custody in an ETF

Spot ETFs centralise custody: a large custodian holds a significant share of the fund’s bitcoin.

Advantage: professional processes, institutional security standards, audited operations.

Disadvantage: concentration of assets at a few intermediaries and thus counterparty risk. Operational errors, legal disputes, or regulatory actions would hit the fund and indirectly the investor.

Direct self-custody makes you independent from third parties: you control the keys. This is core to Bitcoin, but it requires responsibility. Poor self-custody can lead to permanent loss.

Other paths include multi-signature setups or professional custodians with full-reserve rules. It is important to know the difference between true custody and third-party custody.

Trading hours and “paper bitcoin”

ETFs trade during exchange hours. The Bitcoin spot market runs 24/7. Price moves outside exchange hours can make an ETF open at a premium or discount. With good design these gaps are usually small, but they can be larger in stress periods.

There is also the debate about “paper bitcoin”: fund shares are claims on a pool, not the coins themselves. Well-designed spot ETFs make coin backing transparent. Futures ETFs are structurally farther from spot because contract maturities, margin, and rolling mechanics matter.

Positive effects of spot ETFs

- Broader access: invest from your existing brokerage account without learning wallets.

- Deeper liquidity: large regulated inflows can improve price discovery and narrow spreads.

- Institutional adoption: many professional investors can only use regulated vehicles. An ETF meets that need.

- Portfolio integration: advisors can fit bitcoin exposure into strategies, risk budgets, and reporting.

Downsides of ETFs

- Centralisation: big custodians pool holdings and increase concentration risk.

- Counterparty risk: as an ETF investor you rely on the manager, custodian, and clearing chain.

- Structural deviations: cash flows, fees, trading hours, and flows can create short-term tracking gaps.

Advantages of buying Bitcoin directly

Buying directly means you own the asset itself. Three core benefits:

- Sovereignty. You hold your own keys. No counterparty stands between you and your money.

- No ongoing ETF fee. You pay buy/sell and possibly payment or network fees, but no annual management fee.

- Maximum flexibility. Access 24/7. Transfers, partial sales, on-chain transactions, or Lightning use are not limited by a fund’s product design. But there are duties: secure key storage, backup planning, inheritance instructions, and basic technical care. If you cannot or do not want to take this discipline, a regulated vehicle may fit better.

Which path suits which investor?

Beginners focused on simplicity

You already have a broker account, want clear statements, and do not want to set up a wallet? A spot ETF can be a pragmatic start. Look for low costs and a solid structure.

Security-minded, long-term investors

You want to avoid ongoing fees and live Bitcoin’s core benefit of self-sovereignty? Direct purchase with a clean self-custody plan fits. Invest time in education and setup.

Institutional or tightly regulated investors

Internal rules require regulated vehicles, reporting, and processes? A spot ETF is usually the workable route, ideally with efficient in-kind mechanics and high liquidity.

Tactical traders

If you rebalance often, an ETF integrates easily into existing order systems. Direct holdings are more flexible but add on-/off-ramp management.

If rules stop you from buying bitcoin directly or you want everything in your brokerage account and don’t care about the benefits of self custody: choose a Bitcoin ETF (you accept counterparty risk and annual fees, and you own shares, not coins). If you want full control and can manage wallets and keys, buy bitcoin and use self-custody. Bittr follows a self-custody approach and lets you buy straight to your own wallet. You will find options for beginners (e.g., BlueWallet) and advanced users (buying to a hardware wallet). Start here: Buy bitcoin.

Common misconceptions

Myth 1: “An ETF is always cheaper than buying directly.”

Not always. Over long horizons, management fees add up. If you trade rarely and buy well, direct holdings can be cheaper.

Myth 2: “With a spot ETF I basically have the same as owning coins.”

No. You own fund shares, not coins. Redemption in BTC is usually not offered.

Myth 3: “Futures ETFs are equivalent to spot ETFs.”

No. Futures ETFs track contracts, not spot. Depending on market conditions, roll costs and basis gaps can occur.

Myth 4: “Centralised custody is fine: nothing will happen.”

Large custodians reduce your workload but concentrate risks (hacks, seizures, withdrawal halts).

Self-custody: what to keep in mind

- Keep your seed backup offline.

- Buy your hardware wallet from a trusted source.

- Do a small test transaction if you are unsure.

- Write clear instructions for heirs/estate.

- Check regularly and avoid untested software experiments. These steps reduce operational risk and preserve the key advantage of self-custody.

Fee comparison

Think in time horizons. An annual expense ratio eats into your final sum through compounding. With direct holdings and self-custody, most costs are upfront (purchase and network fees) and then very low. With an ETF, you pay for simplicity, reporting, broker integration, and institutional processes. That is fine, but it has a price and risk.

Bottom line: different paths

All paths give you exposure to Bitcoin’s price, but they deliver different values. With an ETF, you buy familiarity, processes, and convenience and you take on third-party custody risk. With direct purchase, you buy sovereignty and remove ongoing management fees, but you accept full personal responsibility.

In the end, choose the path that fits your knowledge, your goals, and your operational discipline.

Final Thoughts

- Spot ETFs make bitcoin easy to hold in a brokerage account, but they charge annual fees and add counterparties.

- Direct ownership avoids the ongoing ETF fee and maximises sovereignty, but it requires solid key and security practices.