What are Mining Pools?

Bitcoin mining pools have changed the way miners collaborate to compete in the tough world of Bitcoin mining. By pooling resources, miners can combine their hash power, share rewards, and keep mining accessible—even for smaller players.

What is Bitcoin Mining?

Bitcoin mining is how new blocks are added to the blockchain and how transactions are verified. It’s no small task—mining requires specialized hardware, plenty of electricity, and the Proof-of-Work system (PoW) to secure the network.

The process works like this: miners guess numbers (Nonces) to find a valid hash to create a valid block. If they succeed, they earn new bitcoin and collect transaction fees from the block they mined. This reward helps cover the significant energy and equipment costs.

Why is Mining challenging?

Mining isn’t as straightforward as it sounds. The industry is highly competitive, and profitability can be elusive. Here’s why:

-

The Difficulty Adjustment: As more miners join the network or improve their equipment, mining becomes harder. This keeps block production steady at about one block every 10 minutes, but it also means miners must constantly innovate to stay in the game.

-

Unpredictable Earnings: Mining rewards aren’t guaranteed. Since the process relies on Probability, miners might work for weeks—or even months—without earning a reward. For large-scale miners, this unpredictability isn’t as big of a deal, but for small operations, it’s a serious challenge.

This is where mining pools come in:

Mining Pools

Mining pools are teams of miners working together to mine blocks. By combining their computing power (hash rate), they increase their odds of earning rewards.

Here’s how it works:

- When one miner in the pool finds a block, the reward is shared among all members based on their contribution to the pool’s total hash rate.

- A pool coordinator manages tasks, ensures no one overlaps efforts, and distributes the rewards. They take a small fee for providing this service. For small miners, joining a pool means consistent income—even if it’s a smaller share. It’s a trade-off that helps them cover costs and stay competitive.

Why Mining Pools exist

Mining pools make it possible for smaller players to participate in an industry dominated by large-scale operations. They exist because:

-

Economies of Scale: Bigger mining operations can negotiate better deals for energy, cooling systems, and space. They can also handle the uncertainty of rewards better than individual miners. Pools help level the playing field by giving smaller miners access to consistent payouts.

-

Distributed Energy Sources: Cheap electricity is spread out globally. Mining pools let miners work from anywhere with affordable energy—whether it’s geothermal power in Iceland or surplus hydroelectric energy in China—while still collaborating.

Why do Mining Pools mine empty blocks?

Despite miners earning more in transaction fees than ever before, we occasionally encounter empty blocks. This seems counterintuitive, doesn’t it?

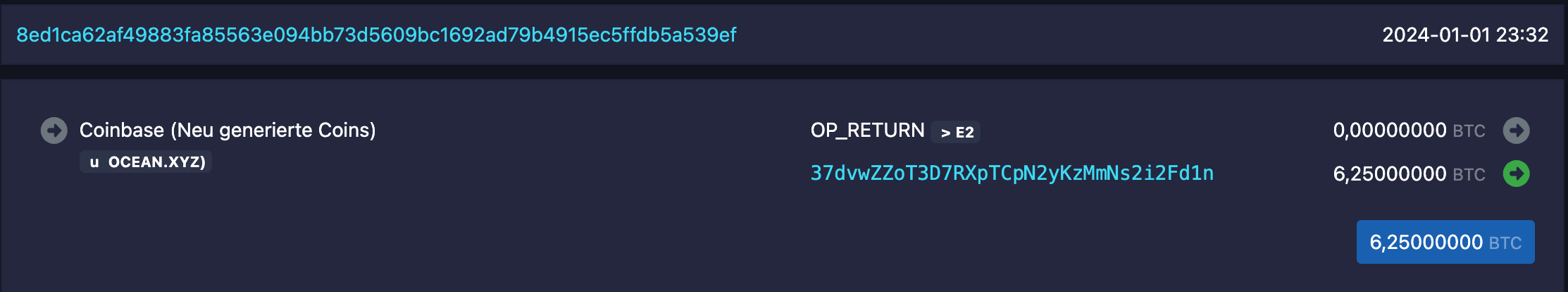

An empty block, in essence, contains only the Coinbase transaction - the process that generates new coins. An empty block would thus look like this:

How does Bitcoin Mining work?

Bitcoin mining involves creating hashes, better understood as “guessing numbers” rather than “solving complex mathematical puzzles”. Each block includes a nonce (which stands for “Number Used Once”), which miners alter to generate different hashes. When a valid hash is discovered, the miner (be it an individual or a mining pool) announces this new block to the network. Other miners, upon recognizing a valid block, shift their focus to finding the next block.

The Role of Mining Pools

Despite the economic incentive to mine full blocks due to rising fees, empty blocks emerge occasionally. In pooled mining, the pool sends a block template based on the previous block’s hash to its miners. Since time is critical in mining, pools initially dispatch an empty block template: a smaller data package than a full block template. The full template, including transactions, follows shortly after, usually within 1 to 2 seconds. This strategy grants the pool a slight head start in hashing.

However, if a miner finds a new block within those few seconds (remember, the average block time is 10 minutes), that block is likely to be empty. Given that the block reward alone can be profitable, miners have an incentive to continue this approach, as long as the block reward remains a significant portion of their earnings.

As long as the block reward is a significant portion of the miner’s profit, he is incentivized to remain with the strategy of mining empty blocks. Understanding these dynamics sheds light on why, despite the potential for higher earnings from transaction fees, miners and pools might still produce empty blocks.

The Benefits of Mining Pools

Mining pools bring stability to what can otherwise be a volatile business:

-

Consistent Earnings: Instead of waiting months for a potential payout, miners in a pool receive smaller, more frequent payments.

-

Keeping Bitcoin Decentralized: Pools allow individuals and small operations to compete with larger players, ensuring that Bitcoin mining isn’t monopolised by a few big corporations.

-

Flexibility for Miners: Miners can switch pools if they find better terms elsewhere, keeping pool operators accountable.

Efforts like Stratum v2, a mining protocol, are even working to make pools more decentralized by giving miners more control over how blocks are constructed.

Final Thoughts

- Mining pools let smaller operations share resources and earn consistent payouts.

- They keep Bitcoin mining decentralised.

- Miners can focus on staying profitable without going it alone.